The Definitive Guide to Boots For Women

Table of Contents6 Easy Facts About Boots For Women ShownNot known Incorrect Statements About Boots For Women

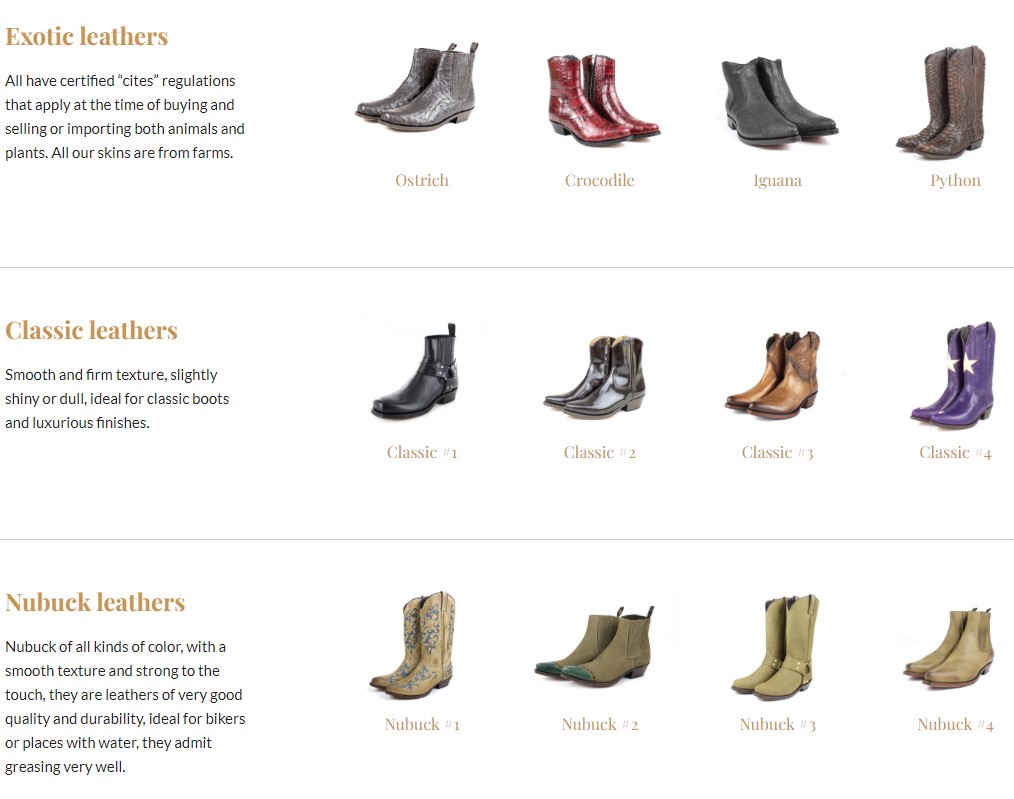

Gown boots supply some improvement to your practical Blundstone boot appearance, and most of Blundstone's dress boots feature natural leather cellular lining. Boots For Women. Carve toe styles give a sleeker layout with a long lasting weather-ready outsole, and can be found in nubuck and leather color choices. Blundstone boots additionally can be found in a cozy and completely dry Thermal Series option and have a sheepskin footbed that creates a cozy, cozy sole in addition to a waterproof * Thinsulate lining:max_bytes(150000):strip_icc()/boot_final-21fa2d982c72498a95890982ee0a21a2.png)

The deal arrangement offers for a so-called "go-shop" duration, throughout which WBA, with the help of Centerview Partners, its monetary advisor, will actively get, and depending upon rate of interest, possibly receive, evaluate and get in into settlements with celebrations that provide alternative proposals - Boots For Women. The first go-shop period is 35 days. There can be no guarantee that this process will certainly cause a superior proposition

These discussions followed Mr. Pessina's recusal from the WBA Board's consideration and analysis of the purchase. As formerly announced, WBA is presently examining a selection of choices with respect to its significant debt and equity passions in the Divested Properties.

An Unbiased View of Boots For Women

Various other info pertaining to the participants in the proxy solicitation and a description of their interests will be had in the proxy declaration and other relevant materials to be filed with the SEC connecting to the proposed transaction - Boots For Women. These papers can be acquired (when readily available) cost-free of fee from the resources showed over

Progressive statements include all declarations that do not associate exclusively to historical or present truths, such as declarations regarding our expectations, intents or techniques pertaining to the future. In many cases, you can determine forward-looking declarations by the use positive terms such as "speed up," "purpose," "aspiration," "expect," "approximate," "aim," "assume," "think," "can," "continue," "could," "develop," "enable," "estimate," "expect," "prolong," "projection," "future," "objective," "support," "mean," "long-term," "may," "model," "continuous," "possibility," "overview," "plan," "placement," "feasible," "possible," "anticipate," "initial," "task," "seek," "should," "strive," "target," "change," "fad," "vision," "will," "would certainly," and variations of these terms or various other similar expressions, although not all forward-looking declarations include these words.

Forward-looking statements are based on existing price quotes, assumptions and ideas and go through known and unknown risks and uncertainties, a number of which are past our control, that may cause real outcomes to differ materially from those suggested by such progressive declarations. Such threats and unpredictabilities include, but are not limited to: (i) the risk that the recommended purchase may not be finished in a timely manner or whatsoever; (ii) the capability of affiliates of Sycamore Partners to obtain the required financing plans set forth in the dedication letters received about the recommended purchase; (iii) the failing to please view it any one of the problems to the consummation of the proposed transaction, including the invoice of particular regulatory approvals and investor authorization; (iv) the occurrence of any kind of occasion, change or other circumstance or condition that could trigger the termination of the deal contracts, consisting of in conditions needing the Firm to pay a discontinuation charge; (v) the impact of the news or pendency of the proposed transaction on the Firm's click reference organization connections, operating results and service normally; (vi) the danger that the recommended purchase interrupts the Firm's current strategies and operations; (vii) the Company's capacity to maintain and hire key workers and maintain partnerships with key organization partners and consumers, and others with whom it works; (viii) risks connected to drawing away management's attention from the Firm's ongoing company operations; (ix) significant or unanticipated costs, costs or expenses resulting from the suggested purchase; (x) possible litigation associating with the recommended purchase that can be set up versus the events to the transaction arrangements or their respective directors, managers or officers, including the results of any kind of outcomes relevant thereto; (xi) unpredictabilities connected to the ongoing accessibility of funding and financing and rating firm activities; (xii) particular constraints during the pendency of the recommended transaction that might affect the Company's ability to seek specific business opportunities or tactical purchases; (xiii) uncertainty as to timing of conclusion of the recommended deal; (xiv) the risk that the useful source holders of Divested Property Proceed Rights will get less-than-anticipated settlements or no payments relative to the Divested Property Proceed Legal rights after the closing of the recommended transaction and that such legal rights will certainly expire worthless; (xv) the effect of unfavorable basic and industry-specific economic and market problems; and (xvi) various other threats described in the Business's filings with the SEC.